- About Us

- Business

- Investor Relations

- ESG

- Careers

- Media Center

- YFY 100th

- A Message from Our Leader

- Company Profile

- Vision and Mission

- Business Strategy

- Our Brand

- Organization

- Achievements

The board has reached a decision of comprising 7 to 13 members in consideration of the company's scale of business development and major shareholders as well as the need for balanced and practical operations. The Board's main responsibilities are to:

Currently there are 7 directors, including 3 independent directors.

| Title | Chairperson |

|---|---|

| Name | Huey-Ching Yeh |

| Background & Experience |

Master of of Economics, National Chengchi University

Chief Secretary of Ministry of Economic Affairs Director-General, Bureau of Energy, Ministry of Economic Affairs Chairman of Ensilence Co.,LTD |

| Notes | Chairman of the Sustainable Development Committee |

| Title | Director |

|---|---|

| Name | David Lo |

| Background & Experience |

Master of Business Administration, S.C. Johnson College of Business, Cornell University, USA

President of YFY Inc. |

| Notes | Sustainable Development Committee |

| Title | Director |

|---|---|

| Name | Chin-San Wang |

| Background & Experience |

EMBA, Accounting and Management Strategy, National Taiwan University

Independent Director, Taiwan Cement Corporation |

| Notes |

| Title | Director |

|---|---|

| Name | Chun-Chieh Huang |

| Background & Experience |

Master of Science and Technology Management Institute, National Chengchi University

President and Partner, Huacheng Capital Co., Ltd. |

| Notes |

| Title | Independent Director |

|---|---|

| Name | Jin-Li Hu |

| Background & Experience |

Ph.D. in Economic, State University of New York at Stony Brook

Professor at the Institute of Business and Management, National Yang Ming Chiao Tung University |

| Notes |

Chairman of the Audit Committee

Chairman of Remuneration Committee Sustainable Development Committee |

| Title | Independent Director |

|---|---|

| Name | Di-Shi Huang |

| Background & Experience |

Master of Criminal Justice Management Institute, Oklahoma City University

Deputy Director of the Ministry of Justice Investigation Bureau |

| Notes |

Audit Committee

Remuneration Committee Sustainable Development Committee |

| Title | Independent Director |

|---|---|

| Name | Yie-Yun Chang |

| Background & Experience |

LL.D in University of Munich

Vice Principal, Fu Jen Catholic University |

| Notes |

Audit Committee

Remuneration Committee Sustainable Development Committee |

Our board diversity policy

3.1On November 13, 2018, the Board passed a resolution to introduce a Code of Corporate Governance. YFY’s board diversity policy is set out in Chapter 3 (Composition and Powers of the Board), Article 19 of the Code. This includes adopting a candidate nomination system and complying with the company’s Director Election Rules and Code of Corporate Governance to ensure the diversity and independence of board members. None of the directors is a spouse or a relative within two degrees of relationship as required by Item 3 and Item of Article 26-3 of the Securities and Exchange Act. None of the independent directors, their spouses or relatives within the second degree of relationship are directors, supervisors or employees of the Company, its affiliates or companies with specific relationships with the Company and do not hold shares in the Company; nor have they provided commercial, legal, financial or accounting services to the Company or its affiliates in the last two years.

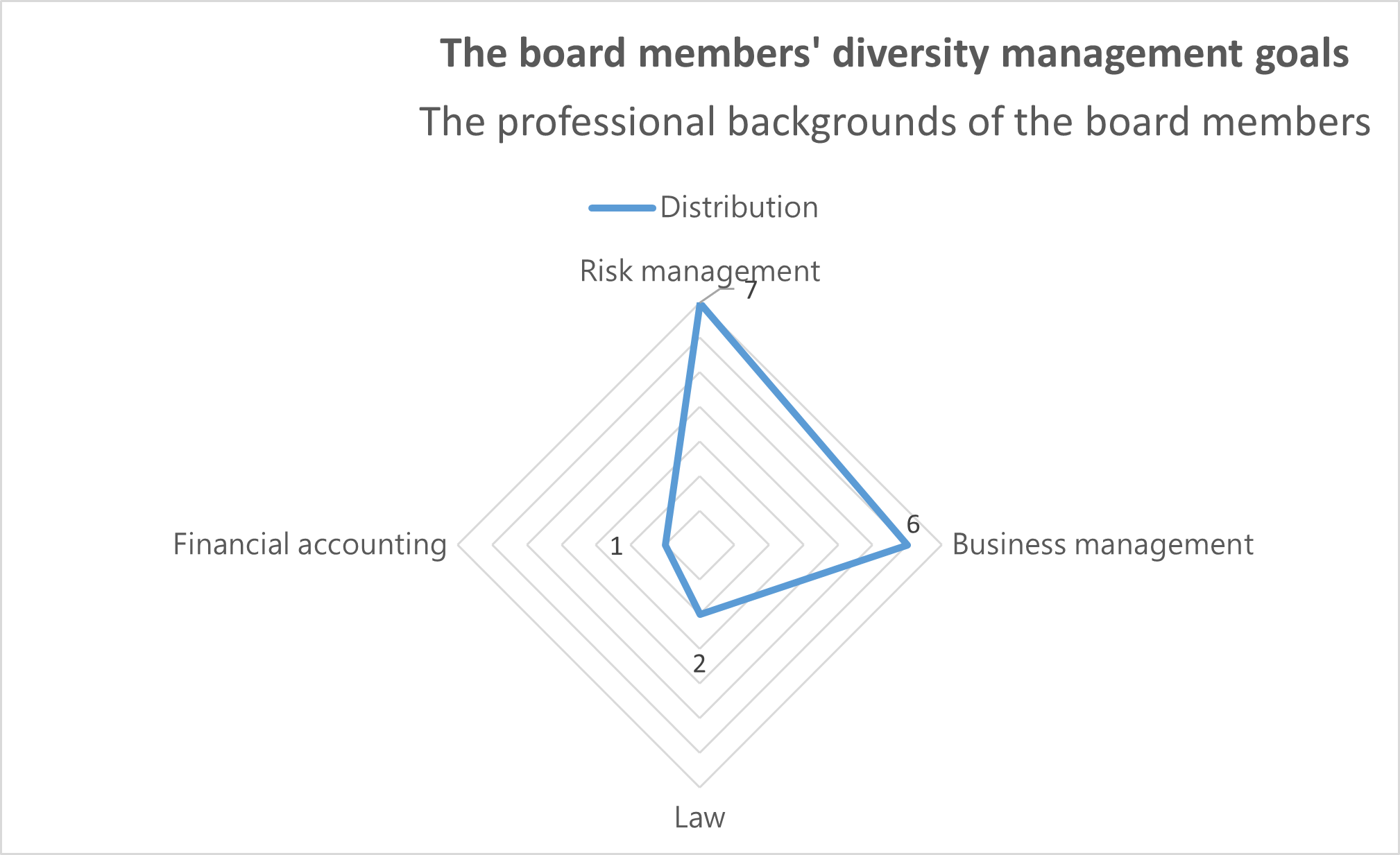

3.2 The Board Members' Diversity Management Goals| The Board Members' Diversity Management Goals | The Achievement of 2024 / Measures Implemented When Goals Are Not Met |

| (1) Directors concurrently serving as company officers not exceed one-third of the total number of the board members | Achieved, currently only 1 manager serve as director. |

| (2) Inclusion of directors of either gender reaching one-third of the seats. |

Not Achieved, currently the board has 1 female director.

Considering the current company development, it is planned to evaluate a candidate list three years later based on company needs, business considerations, risk management, and balanced professional backgrounds, aiming to meet gender diversity management objectives. |

| (3) The professional backgrounds of the board members should encompass business management, financial accounting, legal, and risk management. | (3) The professional backgrounds of the board members should encompass business management, financial accounting, legal, and risk management. Achieved, currently among the board members' backgrounds: 7 in risk management, 6 in business management, 2 in legal, and 1 in finance & accounting. |

The professional background of the directors includes industry, management, and accounting. The members of the 29th Board of Directors who excel in leadership, operational decision-making, business management, and crisis management including directors Huey-Ching Yeh, David Lo, and Chun-Chieh Huang, as well as CPA Chin-San Wang. Independent directors include Jin-Li Hu and Yie-Yun Chang, both are university professors; and Di-Shi Huang has expertise in criminal investigation.

Among the members of the Company's Board of Directors, there are one director with employee status. There are 3 independent directors, and they have served for 3 years. In terms of age, there are 1 director over the age of 70, 4 directors between the age of 60 and 70, 2 directors between the ages of 50 and 60. The Company also emphasizes gender equality in the composition of the Board of Directors. The current term of the Board of Directors includes one female independent director.

| Title | Chairman | Director | Director | Director | Independent Director | Independent Director | Independent Director | |

| Name | Huey-Ching Yeh | David Lo | Chin-San Wang | Chun-Chieh Huang | Jin-li Hu | Di-Shi Huang | Yie-Yun Chang | |

| Basic Background Information | Gender | M | M | M | M | M | M | F |

| Also serves as manager | N | Y | N | N | N | N | N | |

| Ranges of age | 60~70 | 50~60 | >70 | 60~70 | 50~60 | 60~70 | 60~70 | |

| Professional Background | Industry | V | V | V | ||||

| Business Management | V | V | V | V | V | V | ||

| Accounting | V | |||||||

| Professional Competence | The expertise and relevance of the board members to the company's business. | The professional competence of board members. | ||||||

| Leadership | The current board members recruited are all outstanding professional managers and scholars in their respective fields, possessing excellent leadership in internal communication and problem-solving skill for the company. | V | V | V | V | V | V | V |

| Operational Judgments | YFY's various assets are utilized to generate revenue and profit for the company. | V | V | V | V | |||

| Business Management | Board members review the plan, organization, and control of existing resources of YFY according to their decision-making authority, enabling the management team to achieve profit goals | V | V | V | V | V | V | |

| Crisis Management |

In the event of a crisis, providing experiences from various perspectives of industry, government, and academia:

1.How to identify the causes and prevent further damage; 2.How to control risks. |

V | V | V | V | V | ||

| International Market Insights | YFY Inc. is an investment company, with board members whose experiences span across various industries including Bureau of Energy of Economic Affairs, and electrical engineering, banking, venture capital, and more, showcasing rich diversity in business expertise. Among the independent directors, Jin-Li Hu has conducted profound research on how international geopolitical developments influence the economy. | V | V | V | V | |||

| Industry Knowledge | The board members' educational and professional backgrounds encompass the technical aspects of the company and its subsidiaries, as well as industries related to upstream and downstream suppliers/customers, banking, accounting and law. This diverse array of expertise provides multi-faceted industry knowledge and risk management perspectives, contributing to the operational management and analytical decision-making of the company. | V | V | V | V | V | V | V |

| Risk Management | V | V | V | V | V | V | V | |

| Evaluation Cycle | Evaluation Period | Evaluation Scope | Evaluation Method | Evaulation Contents | Evaluation Results |

| The Company completed the performance evaluation of the board and functional committees in 2023 through Internal self-evaluation | From November 1,2022 to October 31, 2023 | The scope of the performance evaluation included the board, individual directors, the Audit Committee, Remuneration Committee and Sustainable Development Committee | The performance evaluation methods include self-evaluation of the Board of Directors, self-evaluation of the directors, and self-evaluation of the Audit Committee, Remuneration Committee and Sustainable Development Committee |

The criteria for evaluating the performance of the Company's Board of Directors shall cover the following five aspects:

1. Understanding and recommendations for the operation of the company. 2. Improvement of the quality of the Board of Directors' decision making. 3. Composition and structure of the Board of Directors. 4. Election and continuing education of the directors. 5. Internal control. The criteria for evaluating the performance of the Company's directors shall cover the following six aspects: 1. Familiarity with the goals and missions of the Company. 2. Awareness of the duties of a director. 3. Understanding and recommendations for the operation of the company. 4. Management of internal relationship and communication. 5. The director's professionalism and continuing education. 6. Internal control. The criteria for evaluating the performance of the Company's Audit Committee and Remuneration Committee shall cover the following five aspects: 1. Understanding and recommendations for the operation of the company. 2. Awareness of the duties of the functional committee. 3. Improvement of the quality of the functional committee's decision making. 4. Functional committee composition and election of members. 5. Internal control. |

The administer of the Board delivered the self-evaluation questionnaire for the performance evaluation to each Director and member of the Audit Committee, Remuneration Committee and Sustainable Development Committee before November 30, 2023 and recovered the questionnaires before December 31, 2023. Base on the evaluation results, all directors were graded as excellent. In 2023, all six of the 2022 external recommendations have been done.

The result of performance evaluation were presented to the board of directors on March 14, 2024. |

| The Company completed the performance evaluation of the board and functional committees in 2024 through internal self-evaluation | From November 1,2023 to October 31, 2024 | The scope of the performance evaluation included the board, individual directors, the Audit Committee, Remuneration Committee and Sustainable Development Committee | The performance evaluation methods include self-evaluation of the Board of Directors, self-evaluation of the directors, and self-evaluation of the Audit Committee, Remuneration Committee and Sustainable Development Committee |

The criteria for evaluating the performance of the Company's Board of Directors shall cover the following five aspects:

1. Understanding and recommendations for the operation of the company. 2. Improvement of the quality of the Board of Directors' decision making. 3. Composition and structure of the Board of Directors. 4. Election and continuing education of the directors. 5. Internal control. The criteria for evaluating the performance of the Company's directors shall cover the following six aspects: 1. Familiarity with the goals and missions of the Company. 2. Awareness of the duties of a director. 3. Understanding and recommendations for the operation of the company. 4. Management of internal relationship and communication. 5. The director's professionalism and continuing education. 6. Internal control. The criteria for evaluating the performance of the Company's Audit Committee and Remuneration Committee shall cover the following five aspects: 1. Understanding and recommendations for the operation of the company. 2. Awareness of the duties of the functional committee. 3. Improvement of the quality of the functional committee's decision making. 4. Functional committee composition and election of members. 5. Internal contro |

Each director of Audit, Remuneration, and Sustainable Development Committee was requested to complete self-evaluation questionnaires for the performance evaluation on November 30, 2024 and returned by December 31, 2024. Base on the self- evaluation, all directors were graded as excellent.

The evaluation result plans to present to the board of directors on March 14, 2025. |

|

The Company’s performance evaluation of the Board of Directors and its functional committees for the year 2025 was conducted through an external evaluation commissioned to the Taiwan Investor Relations Institute (TIRI). The Taiwan Investor Relations Institute is a non-profit organization representing investor relations (IR) professionals of all listed and OTC companies in Taiwan. The Institute appointed Supervisor Hsin-Ning Wan, Director Fu-Fu Shen, and Attorney Hui-Yi Cheng as evaluation committee members. All evaluators declared that they would conduct the evaluation with fairness and objectivity and confirmed that there were no circumstances that would compromise their independence. The evaluation covered the operational performance of the Company’s Board of Directors, including its functional committees. |

From November 1,2024 to October 31, 2025 | The performance evaluation covered the operational performance of the overall Board of Directors, including its functional committees. | The external evaluation institution requested the Company to provide the documents as specified and distributed self-assessment questionnaires related to the performance evaluation to all directors for completion and collection. After appointing three evaluators and obtaining their independence declarations, the evaluation was conducted accordingly. On November 26, 2025, on-site interviews were conducted with the Company’s Chairman, the Convener of Independent Directors, the Chief Corporate Governance Officer, and the Head of Internal Audit. |

The evaluation criteria for the Board of Directors covered the following five dimensions: 1. Board composition and professional development. 2. Quality of board decision-making. 3. Board operational effectiveness. 4. Internal control and risk management. 5. The Board’s level of participation in corporate social responsibility. The evaluation criteria for the functional committees covered the following five dimensions: 1. Degree of participation in the Company’s operations. 2. Understanding of the duties and responsibilities of the functional committees. 3. Enhancement of decision-making quality of the functional committees. 4. Composition and appointment of members of the functional committees. 5. Internal control. |

The external evaluation institution issued its evaluation report on December 8, 2025. The consolidated conclusions and recommendations are summarized as follows: 1. Plan to increase the proportion of female directors to one-third of the Board. 2. Establish a Nomination Committee to strengthen Board functions and governance mechanisms. 3. Pay closer attention to international ESG ratings to enhance trust in international capital markets. The Company plans to submit the evaluation results provided by the external evaluation institution to the Board of Directors in March 2026. |

The aforementioned performance evaluation results were reported to the meeting of the Board of Directors convened in every March meeting as reference for review and improvement.

The company's board of directors is elected by shareholders during the shareholders' meeting. In line with the Corporate Governance 3.0 Sustainable Development Roadmap, which aims to strengthen the independence of directors in listed companies, we advocate for independent directors to serve no more than three consecutive terms. This policy ensures generational turnover in director and independent director selections.

To maintain continuity and stability, the board member turnover rate should not be excessively high during each election. This approach facilitates the transfer of management and governance experience from the outgoing board to the incoming one. Our company provides regular training programs for directors and key management, enhancing their professional expertise across a wide array of topics essential to corporate governance. These topics include finance, business strategy, legal compliance, accounting principles, ESG standards, and internal control systems. We ensure that every director, including those serving in dual roles, receives information relevant to their responsibilities. With a minimum of six hours of training annually per individual, our commitment guarantees that our board members and key management uphold exemplary corporate governance practices.

Furthermore, we invest in nurturing potential successors within our organization. We also actively seek accomplished individuals with diverse backgrounds in business, legal, finance, accounting, or corporate affairs to serve as directors or independent directors. This is part of our strategic succession plan for the future.